Update 23/12/2019: At the COP25 climate summit in Madrid in December 2019 and despite considerable progress, negotiators were unable to agree the rules for “Article 6”. To understand what happened at COP25, and how Article 6 negotiations played out, read the in-depth Carbon Brief summary of the talks.

A little-known and highly technical section of the Paris Agreement could “make or break” the regime – and its aim of avoiding dangerous climate change.

These “Article 6” rules, for carbon markets and other forms of international cooperation, are the last piece of the Paris regime to be resolved, after the rest of its “rulebook” was agreed in late 2018.

To its proponents, Article 6 offers a path to significantly raising climate ambition or lowering costs, while engaging the private sector and spreading finance, technology and expertise into new areas.

To its critics, it risks fatally undermining the ambition of the Paris Agreement at a time when there is clear evidence of the need to go further and faster to avoid the worst effects of climate change.

If the Article 6 rulebook is to be agreed, a set of interlocking, overlapping and conflicting national priorities – a veritable “four-dimensional spaghetti” of red lines – will have to be traded off at the December COP25 UN climate talks in Madrid, or, failing that, at COP26 in Glasgow in 2020.

This is a classic example of the horse-trading that characterises international negotiations. But the stakes are high ahead of the crunch 2020 talks, where countries are due to raise their currently inadequate ambition towards the 1.5C and “well-below 2C” twin goals of the Paris Agreement.

In this in-depth Q&A, Carbon Brief breaks down the Article 6 text, explaining the key points of contention and how they might be resolved.

On 1 January 2020, a new international climate regime will take effect under the 2015 Paris Agreement, according to detailed rules agreed at the COP24 climate summit in December 2018.

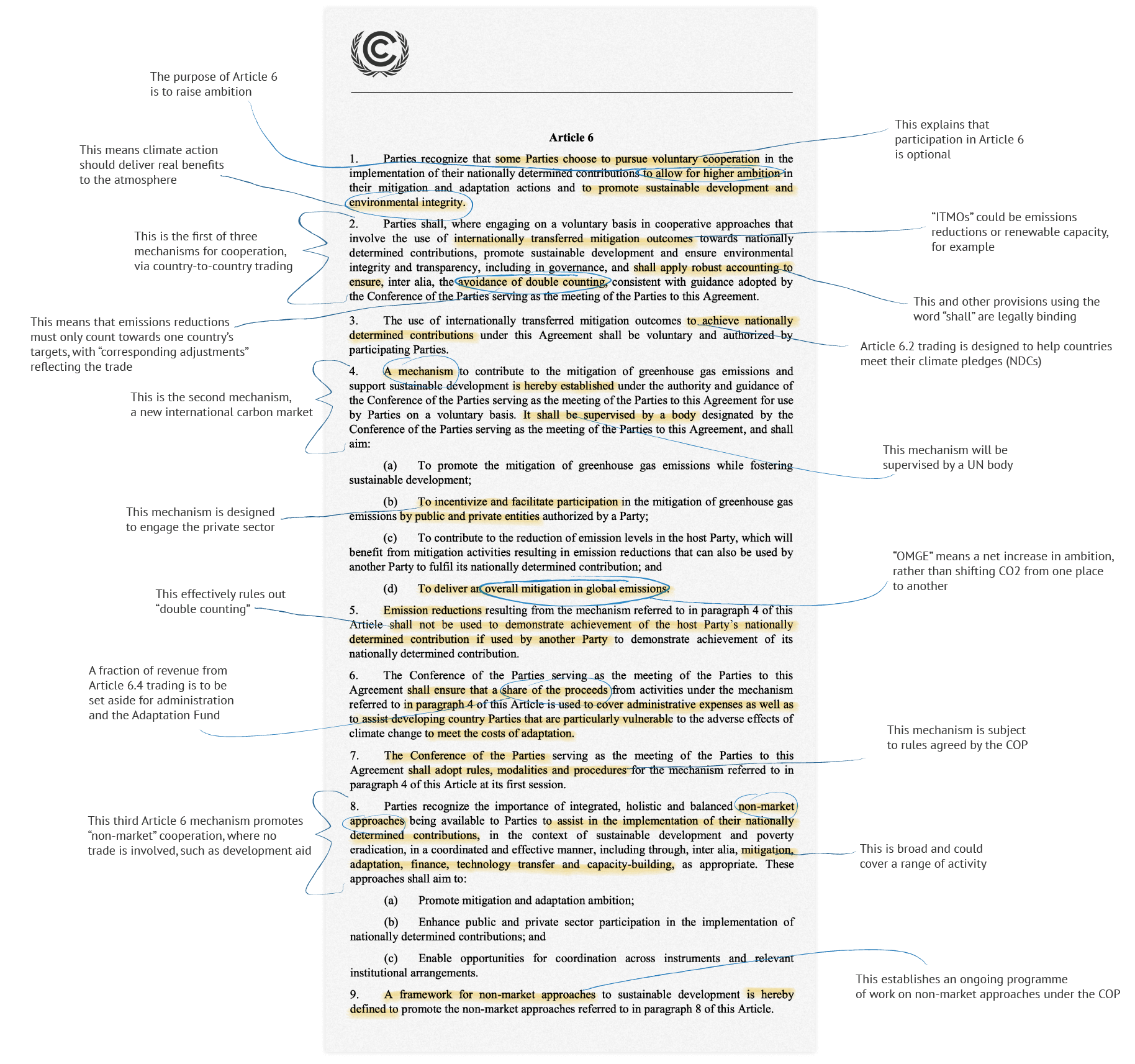

But one piece of that regime is unresolved, having proved so contentious that countries have been unable to agree the rules governing its use. This is Article 6 of the Paris Agreement, covering a single side of A4 and containing just nine densely worded paragraphs (6.1 through 6.9).

This short text contains three separate mechanisms for “voluntary cooperation” towards climate goals: two based on markets and a third based on “non-market approaches”. The text outlines requirements for those taking part, but leaves the details – the Article 6 “rulebook” – undecided.

In simple terms, the first mechanism would allow a country that has beaten its Paris climate pledge to sell any overachievement to a nation that has fallen short against its own goals. This overachievement could be in terms of emissions cuts, but might also cover other types of target. For example, some countries have set goals for renewable energy capacity or forest expansion.

The second mechanism would create a new international carbon market, governed by a UN body, for the trading of emissions reductions created anywhere in the world by the public or private sector. Carbon credits could, for example, be generated by a new renewable power plant, an emissions-saving factory upgrade or the restoration of an area of forest.

(It remains undecided whether to include projects reducing emissions from deforestation and forest degradation, known as “REDD”, within the Article 6 scheme.)

This new market is sometimes referred to as the “Sustainable Development Mechanism” (SDM). It would replace the Clean Development Mechanism (CDM), which operated under the predecessor to the Paris Agreement, known as the Kyoto Protocol, which gave developed countries legally-binding emissions targets that applied from the start of 2008 until 2012.

(Targets for a second commitment period, running until the end of 2020, were adopted in the “Doha Amendment”, but this has yet to enter force. EU states have pledged to meet it anyway.)

The final Article 6 mechanism for “non-market approaches” is less well defined, but would provide a formal framework for climate cooperation between countries, where no trade is involved, such as development aid.

This could include similar activities to those under the other mechanisms – support for a new windfarm, for example – but without any buying and selling of the resulting CO2 savings.

The three separate mechanisms – under Article 6.2, 6.4 and 6.8 – all became part of the Paris deal in recognition of the different interests and priorities among parties to the agreement. These differences remain and must be traded off once again, if the Article 6 rulebook is to be agreed.

In order to finalise the rulebook, negotiators must navigate a thicket of impenetrable jargon, a series of technical accounting challenges and bear-traps of “constructive ambiguity” in the text, that hide often incompatible visions of how Article 6 should work and what it was created for in the first place.

The negotiations are also embedded in the decades-long political context of the UN climate talks, subject to all its usual battlegrounds over ambition, finance, support for vulnerable nations and the extent to which climate action should be nationally versus internationally determined.

The challenge this represents is clear from the fact that Article 6 was the only part of the Paris rulebook that could not be agreed at COP24 in December 2018.

Whereas draft negotiating texts for each other part of the rulebook were progressively whittled down during that two-week meeting, the sections on Article 6 remained stuck, with 132 unresolved sections of text contained in “square brackets”, shown in the chart below in red.

Number of square brackets, indicating areas of disagreement, in successive drafts of the Paris Agreement “rulebook”, broken down by the relevant article of the deal. Apart from Article 6 carbon markets, shown in red, all sections reached zero brackets and were agreed by the end of COP24 on 15 December 2018. Source: Carbon Brief analysis of negotiating texts published by the UN climate body UNFCCC. Chart by Carbon Brief using Highcharts.

The chart also shows how the draft Article 6 texts appear to have gone backwards, after talks in Bonn in June 2019 (rightmost column in the chart). As things stand, the draft rulebook texts on Article 6.2, Article 6.4 and Article 6.8 cover 41 pages, containing 672 square brackets.

The increased number of unresolved areas in the text after the Bonn meeting reflects a retrenchment, with many countries and negotiating blocs at the talks retreating to their starting positions having previously given way in a spirit of compromise at COP24.

This retrenchment means that issues and red lines can once again be traded off against each other as negotiators work towards agreement across the Article 6 rulebook. There could also be attempts to tie these talks to other political priorities at the COP, further complicating matters.

Kelley Kizzier, now associate vice president for international climate at US NGO the Environmental Defense Fund (EDF), was co-chair of the Article 6 negotiations at COP24. She tells Carbon Brief:

“The reason we got as far as we did in Katowice is that people were expecting a deal. Those compromises were made in the context of a deal, so when a deal doesn’t materialise, of course, people back off from their compromises.”

Despite this setback, Kizzier says that “the heart of a deal on Article 6 is still there on the table”. She adds: “There are some crux issues that still need to be resolved, but once those are agreed the text could come together very quickly.”

At the international climate summit at COP25 in Madrid, in December 2019, climate negotiators will try once again to finalise the Article 6 “rulebook”, which will govern voluntary international cooperation on climate change, including carbon markets.

To truly understand the task they face and the key areas of remaining disagreement, the first port of call is the text of Article 6 of the Paris Agreement itself, shown in annotated form in the graphic, below.

The remainder of this section walks through each of the paragraphs of Article 6 in turn, quoting key snippets and wordings directly from the Paris text.

Article 6.1 sets the tone for the rest of the text, even though it does not strictly apply to the remaining paragraphs. It says that where countries use “voluntary cooperation” via the Article 6 mechanisms, this is “to allow for higher ambition in their mitigation and adaptation actions”.

The paragraph says that cooperation is to take place in the context of promoting “sustainable development and environmental integrity”. In broad terms, environmental integrity means that action should result in real benefits to the atmosphere, rather than targets being artificially met.

Next, the first of the three mechanisms is set out in Article 6.2, allowing countries to voluntarily trade “mitigation outcomes” for use towards their Paris pledges, provided they promote sustainable development, while ensuring environmental integrity and transparency. Here, “transparency” is a reference to the reporting requirements on all countries under the Paris regime.

The nature of the “internationally transferred mitigation outcomes” (ITMOs) referred to under Article 6.2 is subject to debate, with some countries wanting to decide for themselves what they can trade and others wanting all trades to be in terms of emissions measured in tonnes of CO2e.

![]()

CO2 equivalent: Greenhouse gases can be expressed in terms of carbon dioxide equivalent, or CO2e. For a given amount, different greenhouse gases trap different amounts of heat in the atmosphere, a quantity known as the global warming potential. Carbon dioxide equivalent is a way of comparing emissions from all greenhouse gases, not just carbon dioxide.

CO2 equivalent: Greenhouse gases can be expressed in terms of carbon dioxide equivalent, or CO2e. For a given amount, different greenhouse gases trap different amounts of heat in the atmosphere, a quantity known as… Read More

ITMOs might, therefore, include emissions cuts or, for example, renewable capacity or hectares of newly planted forest. Countries could also link emissions-trading systems via this mechanism.

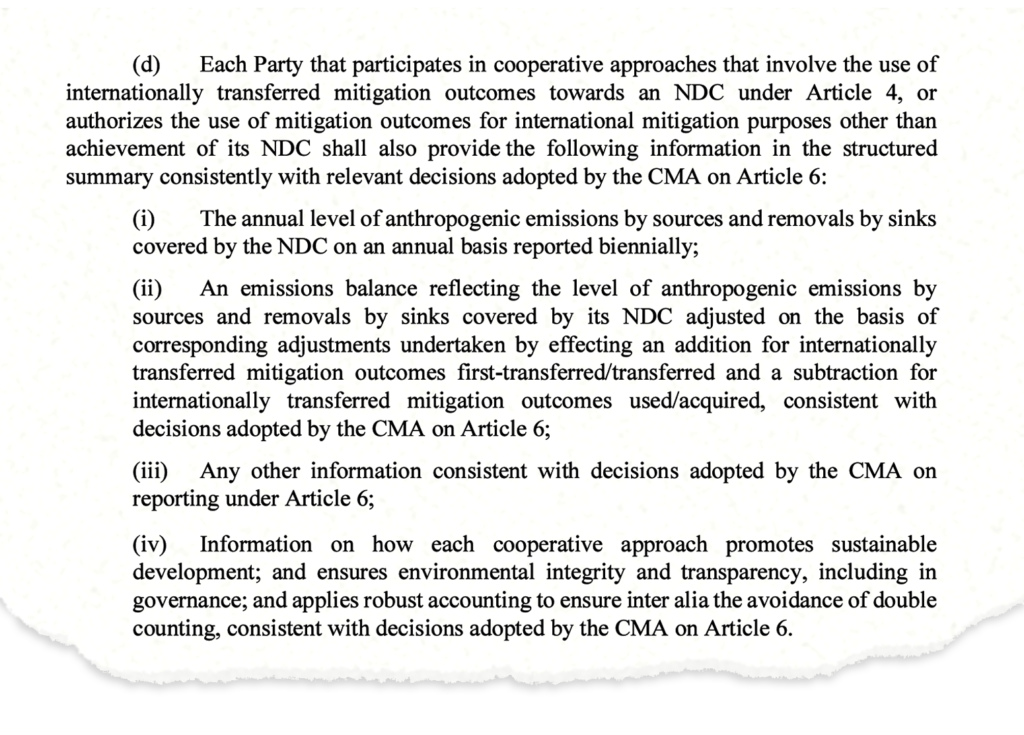

Trades under Article 6.2 are subject to “robust accounting to ensure…the avoidance of double counting”, meaning each ITMO must only count towards the targets in one country’s “nationally determined contribution” (its NDC or climate pledge).

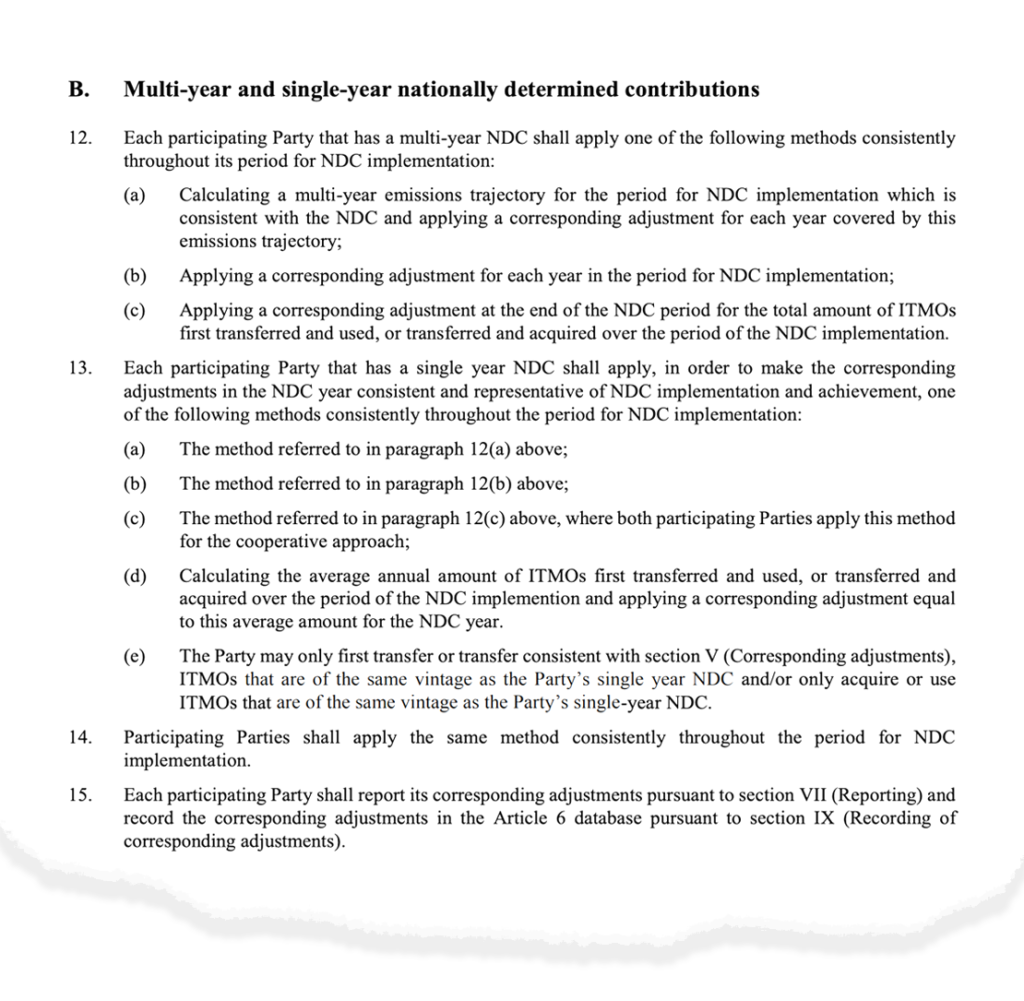

The precise form of this “robust” Article 6.2 accounting is a key focus of the ongoing negotiations, with one of several technical challenges being how to deal with trades between NDCs that target emissions in a single year, versus those that set a carbon budget covering multiple years.

The Paris “decision” text, also adopted at COP21, asks that accounting guidance be drawn up, based on the idea of “corresponding adjustments” to the greenhouse gas emissions and removals covered by each country’s NDC – effectively a form of double-entry bookkeeping.

Countries buying or selling ITMOs must avoid double-counting in a way that is “consistent” with this guidance, meaning they may be able to choose their own “robust accounting” methodology. Article 6.3 then reaffirms that use of ITMOs is voluntary and must be “authorised by participating parties”.

The second trading mechanism is introduced by Article 6.4, which creates a new international carbon market and a body to supervise its operation. Whereas Article 6.2 involves trading between countries, Article 6.4 revolves around projects carried out by “public and private entities”.

Indeed, Article 6 is the only part of the text that directly refers to private sector participation in the Paris process. Article 6.4 projects might include the restoration of a degraded forest, an upgrade to a factory or the construction of a different type of power plant with lower emissions.

Dirk Forrister, president of industry group the International Emissions Trading Association (IETA) tells Carbon Brief:

“As you go forward, the role of forests, soils, blue carbon, technological solutions [to removing CO2 from the atmosphere], those all come into play. But in the early stages this is about squeezing as much carbon as possible out of the global energy system.”

Article 6.4 activities are to generate “real, measurable, and long-term” emissions reductions in the host nation, which will “benefit” from this mitigation. Here, “long-term” reflects the fact that some emissions reductions might not be permanent, for example, a restored forest could burn down.

The cuts in CO2e are likely to be eligible to offset emissions from air travel under the International Civil Aviation Authority (ICAO) Corsia scheme, though it is not named directly in the Paris text. (Corsia is the UN scheme for offsetting airline emissions.) Somewhat cryptically, the draft Article 6.4 rulebook refers instead to “purposes other than contributions towards NDCs”, using language that could cover Corsia or other future schemes.

Alternatively, the Article 6.4 carbon reductions “can also be used by another party to fulfil its NDC”. Crucially, Article 6.5 specifies that these savings “shall not be used” by the host nation to meet its own NDC, if they are also being used to meet NDC targets in another country. Similar constraints are likely to apply to use under Corsia.

The precise approach to avoiding the use of emissions reductions by more than one country is an area of significant disagreement. It is closely related to the idea of double-counting under Article 6.2, with both raising issues around what counts as “inside” versus “outside” the scope of a country’s NDC, given some pledges only cover part of the economy.

Delegates gather for informal consultations on matters relating to Article 6 of the Paris Agreement, Bonn, Germany, 26 June 2019. Credit: IISD/ENB | Kiara Worth.

The Article 6.4 mechanism effectively replaces the Clean Development Mechanism (CDM) of the Kyoto Protocol. The CDM and other carbon trading arrangements under Kyoto have long been subject to controversy and accusations of generating “hot air”. In other words, emissions reductions that are effectively worthless because they would have happened anyway.

(This accusation is implicitly recognised in the international market for CDM credits, where carbon offsets are currently valued at close to $0.2/tCO2e.)

Therefore, there is disagreement over whether – and, if so, how – to allow the many Kyoto-era mitigation methodologies, projects and carbon credits into the Article 6.4 market.

Several countries that are host to large numbers of ongoing CDM projects, such as Brazil and India, are keen to allow a full transition, whereas others fear this could undermine Paris ambition by allowing already-weak targets to be met without any additional effort to cut emissions.

Next, the Article 6.4 text says the market mechanism must deliver an “overall mitigation in global emissions” (OMGE). This means that mitigation should go beyond what would have happened if the trading scheme had not been in place.

In contrast, it has been argued that the CDM delivered, at best, a “zero sum” transfer of CO2 reductions between countries. At worst, the CDM stands accused of having actively undermined targets, which were able to be met through “hot air” credits that did not deliver real CO2 cuts.

There is strong disagreement over how OMGE should be guaranteed in practice.

According to the Paris decision text, emissions reductions created by Article 6.4 must be “additional to any that would otherwise occur”. There is debate over what this means and how to measure the baseline of what would have “otherwise occur[ed]”.

The current negotiating text includes various “baseline” tests to ensure additionality, including a square-bracketed option that could set the bar as action that goes beyond what would be needed for the host country to meet its climate pledge (NDC). The option text says:

“[Emissions reductions are [complementary][additional] to the policies and measures [implemented][needed] to achieve the NDC of the host Party.]”

This speaks to the idea, discussed during COP21, but not included in the Paris text, that emission savings under Article 6.4 should go “beyond the NDC” of the host nation. Some argue that the use of strict baselines would guarantee “OMGE”, the net mitigation benefit required under Article 6.4.

This highlights one cause of disagreement on Article 6.4, namely, that, under Kyoto, CDM hosts did not have their own goals for cutting emissions, meaning it was impossible for savings to be “double-counted” towards more than one target.

According to Article 6.6, a yet-to-be-decided “share of the proceeds” from trading under Article 6.4 is to be set aside and paid into the Adaptation Fund, which supports adaptation and resilience in developing countries. (A 2% share of proceeds was set aside under the CDM.) Another share of Article 6.4 proceeds is to be set aside to cover market administration.

The level of the adaptation share of proceeds is an important political issue within the Article 6 negotiations, particularly for vulnerable small-island developing states. These countries are also pushing for automatic cancellation of a fraction of Article 6.4 credits, as a means to ensure OMGE.

Although Article 6.7 says the annual COP “shall adopt rules, modalities and procedures” for the Article 6.4 carbon market, there is disagreement over the extent of national control of its operation, versus the UN supervisory body signing off on each individual project or methodology.

The third mechanism for voluntary cooperation under Paris is introduced in Article 6.8. This recognises “non-market” approaches to boost “mitigation, adaptation, finance, technology transfer and capacity-building”, in situations where no trade is involved.

This could involve similar activities to those under Article 6.2 or 6.4, without the added element of trading. For example, a country could support a renewable energy scheme overseas via concessional loan finance, but there would be no trading of any emissions cuts generated.

Non-market approaches might also overlap with other parts of the Paris deal on climate finance (Article 9), capacity building (Article 11) or education and public awareness (Article 12).

Finally, Article 6.9 establishes a “framework” – an ongoing programme of work under the COP – that will “promote” the non-market approaches set out in Article 6.8.

As the last unresolved piece of the Paris Agreement “rulebook”, the Article 6 negotiations have symbolic significance to the overall regime, which is due to take effect at the start of 2020.

More substantively, the implementation of Article 6 has the potential to make or break the Paris regime, according to its respective proponents and critics.

The opening paragraph of Article 6 of the Paris Agreement envisions a system that:

“Allow[s] for higher ambition in [countries’] mitigation and adaptation actions and [that] promote[s] sustainable development and environmental integrity”.

Supporters argue that a well-designed Article 6 framework could do just that – helping countries significantly ramp up their efforts to tackle climate change. Similarly, the delivery of an “overall mitigation in global emissions” (OMGE) is a key requirement of the Article 6.4 mechanism.

Modelling estimates have placed the potential savings from a globally integrated carbon market under Article 6 as high as hundreds of billions of dollars every year, which could, theoretically, be funnelled into further emissions cuts to raise ambition.

If this happened, it would increase overall ambition and could help meet the aspirational 1.5C target set out by the Paris Agreement, compared with pledges that are currently insufficient.

Article 6 could also provide a means of incorporating climate commitments by businesses into the wider UN process and replacing earlier trading arrangements that many observers – and international market participants themselves – now consider to be virtually worthless.

Another potential benefit from international trading is explained by IETA president Dirk Forrister. He tells Carbon Brief that the potential to cut greenhouse gas emissions and balance any that remain with removals is not spread evenly around the world.

He says that this means – particularly as countries start looking towards net-zero emissions – that there is a need for a global trading system so they can achieve emissions “balance” cooperatively.

Oil and gas companies have been supportive of the market-based approaches covered by Article 6, working through groups such as IETA to see them incorporated into international climate commitments, as Shell’s chief climate change adviser David Hone explains to Carbon Brief:

“In short, we struggle to see how net-zero emissions is achieved without it.”

(The UK’s official climate advisers have recommended that the country’s net-zero target be met without the use of international trading, though this option has not been firmly ruled out.)

The Article 6.4 text also says the COP will ensure that a “share of the proceeds” shall “assist developing country parties that are particularly vulnerable to the adverse effects of climate change to meet the costs of adaptation” (as well as “covering administration expenses”).

This means it could become another route to channel climate finance from richer nations to developing countries, supplementing existing measures, such as the Green Climate Fund.

Proponents of Article 6 argue it could help reduce emissions in two ways.

First, the principle of OMGE within Article 6.4 has the potential to go beyond offsetting and the “zero-sum game” established by the Kyoto markets (see below). The result would be the buying and selling of carbon credits directly leading to lower emissions.

Second, trading could help reduce emissions by making it easier and cheaper for countries to meet their climate targets, in the process encouraging them to set increasingly ambitious goals.

Some 96 country climate pledges – about half of all NDCs – refer to the use of carbon pricing initiatives, according to a World Bank report. It suggests that the cost of meeting current NDCs could be cut by as much as 50% “in principle…with a fully global, friction-free carbon market”.

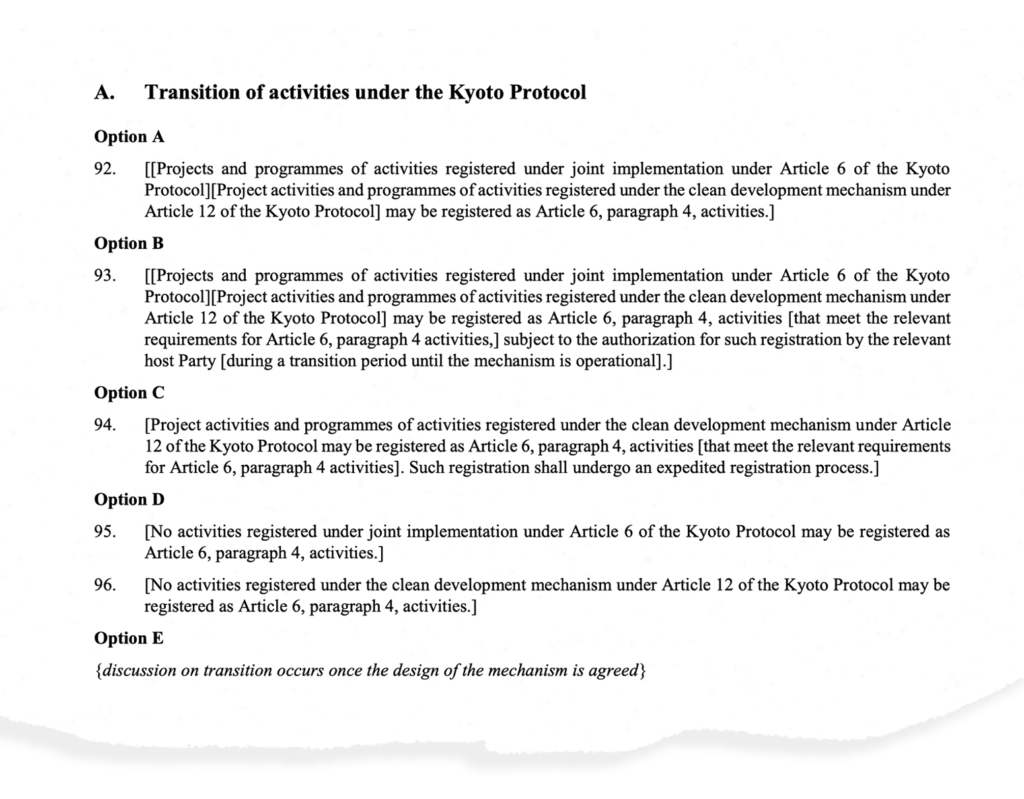

Another report produced by IETA and the Carbon Pricing Leadership Coalition – a grouping administered by the World Bank – says trading could save $250bn every year by 2030.

This estimate comes from a study using GCAM, an “integrated assessment model” of the world’s energy system, which includes a simplified representation of the global climate and economy.

It shows that under a modelled Article 6 carbon market, countries in Europe, North America and other regions (shades of blue in the chart, below) would meet part of their climate goals by buying credits from developing nations in Asia – in particular, India (orange) and Pakistan (orange).

Emissions trading in a model of an Article 6.4 global market, showing buyers in shades of blue and sellers in shades of yellow, orange, red and purple. China and Africa, shown in grey and black respectively, are initially among those selling emissions reductions to the market, but later become buyers. Source: IETA/CPLC report based on research by the Pacific Northwest National Laboratory. Chart by Carbon Brief using Highcharts.

(The model results shown above only include trading of emissions reductions from fossil fuel use and industry. The buyer-seller split depends on the relative wealth of countries, as well as the ambition of their climate goals and the carbon intensity of their energy and industrial systems. For example, if coal-fired electricity generation in India is assumed to be cheaper than low-carbon alternatives, then a carbon market could incentivise a shift towards renewables or nuclear. In a forthcoming study, the same team also models trade in “natural climate solutions” for cutting emissions, such as forest rehabilitation. These results show Brazil and other South American countries becoming significant sellers of carbon credits under a modelled Article 6 scheme. Notably, Dufrasne tells Carbon Brief that Brazil is “strongly advocating against the use” of forests within the Article 6 mechanisms, despite its potential to profit from their inclusion.)

IETA’s report, modelling up to $250bn in reduced costs to meet current climate goals, says that if countries are “inspired to invest these cost savings in enhanced ambition”, then targets could be boosted by 50%. This would cut an additional 5bn tonnes of CO2 equivalent (GtCO2e) annually by 2030, against current pledges that would save 10GtCO2e.

Meanwhile, a paper by the Environmental Defense Fund says emissions trading systems can “lower political resistance to more ambitious targets”, citing examples from the EU Emissions Trading System, the Regional Greenhouse Gas Initiative and California’s cap-and-trade programme. It concludes that with global carbon markets, climate ambition could be nearly doubled over the next 15 years, relative to current NDCs.

However, the potential of carbon markets to drive change is the source of much debate.

Responding to IETA’s study on the potential cost savings from trading, Gilles Dufrasne from the NGO Carbon Market Watch tells Carbon Brief he thinks it is “interesting from a purely theoretical angle, but does not reflect the real-world use and potential impacts of carbon markets”.

Aside from assuming a perfect, fully integrated market in which the cheapest emissions-cutting options are always exploited first, Dufrasne says the “biggest and most problematic assumption” is that cost savings would be reinvested in extra mitigation, leading to higher ambition. “There is no evidence for this anywhere,” he says.

Hector Pollitt, an economist at consultancy Cambridge Econometrics, has previously dismissed the idea that carbon pricing is the most cost-effective way to cut emissions as “neoclassical fantasy”.

He tells Carbon Brief that, while he does “genuinely believe that without a strong carbon price we won’t get much done”, he is concerned that a focus on pricing alone will distract from the “other regulations and policies that are required for deep decarbonisation”.

This could make targets harder to meet in the long run, Pollitt says, if it means that the technologies needed to reach net-zero emissions have not been developed.

Forrister, who co-wrote the IETA report, says that while its estimate is indeed based on an idealised model of the world, it nevertheless gives a sense of the “size of the prize”.

The numbers are so big, he adds, that there could be significant gains, even if the “total global nirvana” of an internationally harmonised carbon market is not achieved. For example, with smaller pockets of carbon trading in certain regions.

As it stands, only eight of the countries with NDCs – Canada, Japan, Liechtenstein, Monaco, New Zealand, Norway, South Korea and Switzerland – explicitly say they plan to use international credits to meet their targets.

Among the others, several rule out using these credits, while others suggest using them to go even further and meet more ambitious goals.

Given the limited number of countries that have confirmed they will use international credits, and the fact they are not currently allowed for compliance under most national and regional carbon markets, it is currently unclear how much demand there will be for these credits.

Aerial view of Los Angeles International Airport. Credit: blphoto / Alamy Stock Photo.

After years of international aviation being excluded from trading schemes, the biggest market is expected to be Corsia, as well as private companies.

In fact, incentivising mitigation activities by private entities should be a key outcome of Article 6.4, as Forrister tells Carbon Brief:

“It’s one of the main parts of the Paris Agreement that could directly apply to the private sector, unlocking private-sector finance. It’s an area where business and environmental organisations have a shared interest in integrity and the potential to unlock ambition.”

Matthew Bell, former chief executive of the UK’s Committee on Climate Change and now a director for consultancy Frontier Economics says there is a growing need for credible offsets to help businesses meet the increasingly ambitious climate goals they are setting.

But he tells Carbon Brief there will be limited private investment in Article 6.4 projects if the system allows “credits that are not credible”. This point is echoed by IETA, which besides offering positive estimates of future carbon markets, also notes:

“The rules are critical. If written poorly, then rather than facilitate additional emissions reductions they could frustrate meeting current contributions and undercut progress.”

It is this delicate balance that led Kelly Levin from the World Resources Institute to tell a recent press briefing that the Article 6 rules have the capacity to “make or break” the ambition of the Paris Agreement.

At its best, supporters argue that Article 6 could offer countries and businesses a chance to work together collectively to cut carbon emissions faster than currently planned. However, there is also concern that, far from enhancing Paris targets, Article 6 could undermine the entire process.

Arriving at a Paris Agreement that satisfied everyone meant leaving a certain amount of “constructive ambiguity” in the text. In turn, that means there has been room for a range of interpretations when formulating the rulebook.

If the final rulebook leaves too much flexibility, then there are fears that Article 6 cooperation could lead to no overall climate benefit or, even worse, result in more CO2 being emitted.

Given these fears, while acknowledging the technical complexity and large amounts of investment potentially involved, Costa Rican negotiator Felipe De Leon tells Carbon Brief that the stakes are high and that there are some key points which, in his view, cannot be compromised:

“There is a wrong side and a right side [for these issues]. There is a ‘world is flat’ and a ‘world is not flat’…Article 6 has this capacity to proactively undermine [climate action] in a way that almost no other part of the Paris Agreement has.”

At the COP24 talks in December 2018, it was widely reported that Brazil was pushing for rules seen as unacceptable to many other countries. Carbon Brief understands that Brazil has some backing from Russia and India, though this support has often been unspoken during formal talks.

Perhaps the biggest concern is of a system that would allow “double-counting”, meaning emissions cuts could be counted towards the targets of both the party selling the credits and the one buying them. (Brazil’s position and the issue of double-counting are explained in more detail below.)

The clash between these nations and parties concerned with maintaining the “environmental integrity” of global carbon markets is the source of much of the ongoing delay in proceedings.

Other contentious issues have been how Article 6.4 can ensure an overall cut in emissions, how to prevent its supply of credits from vastly exceeding demand and how to stop countries adopting weaker climate targets just so they can sell more credits.

There is a risk that if Article 6 rules are not tight enough, nations will face “perverse incentives” to avoid raising their climate ambitions. They could deliberately exclude parts of their economies from their NDCs, so as to be able to sell any related emissions reductions on the global market instead.

(All of these issues, and the conversations around them, are explained in greater depth in the section below.)

There have also been concerns about how to ensure that emissions-cutting projects do not harm local people or the environment.

Carbon pricing has already been implemented by dozens of countries and subnational governments, but as the NGO Carbon Market Watch explains in a report on the subject, “establishing a global, or even national, carbon market is a challenging task”.

“There are significant risks that the systems contain loopholes which can result in this policy having little-to-no impact on reducing emissions.”

The Paris decision text says that the Article 6.4 mechanism should draw on “experience gained with and lessons learned from existing mechanisms and approaches adopted under the Convention and its related legal instruments”. This is a reference to the Kyoto Protocol.

The main Kyoto market, the Clean Development Mechanism (CDM), allows developed countries to buy carbon credits generated in developing nations, called Certified Emission Reductions (CERs), representing emissions cuts in those places.

A replacement scheme, if adopted under Article 6.4, could set the stage for countries to adopt more ambitious targets, as it should make their goals cheaper to meet. But as Carbon Market Watch explains, things are a little more complicated:

“In practice, it is very difficult to establish a clear relationship between the ability to buy cheap carbon credits and a country’s willingness to commit to more climate action. In certain cases, the opposite can happen, as countries prefer to sell their emission reductions instead of using them to meet their own targets.”

The CDM is widely viewed as a failure. Rather than driving more ambitious targets, analysts think most of the emissions reductions under the CDM would have happened anyway, either because they made financial sense without credits or were required by law.

The other two carbon markets established under the Kyoto protocol are known as International Emissions Trading and Joint Implementation, and deal with trading between wealthy countries.

Weak emissions targets under Kyoto meant these two systems left many nations with a huge surplus of credits, despite having undertaken little in the way of significant climate action.

An often-cited example is the collapse of the Soviet Union, which led to an economic downturn that left ex-Soviet countries rich in largely meaningless credits. This phenomenon, dubbed “hot air”, has been flagged as another potential problem for the Paris regime.

The risks come both from old Kyoto credits being carried forward into the new system and from new, potentially equally worthless credits being generated by countries that overachieve on weak NDCs and then trade the surplus under Article 6.2 rules.

Dufrasne has previously pointed Carbon Brief to research suggesting between 18 and 28bn tonnes of CO2 equivalent credits could be generated thanks to weak NDCs being easily overachieved.

As of the Bonn session in June 2019, negotiators had failed to whittle down the list of potential options in the draft rulebook text, instead opting to simplify and organise the choices available. This leaves on the table proposals that are seen by some parties as totally unacceptable.

As Dufrasne explains, all of the “craziest options” are still in the text:

“It is hard to imagine how countries will agree on the good options and the proper accounting rules [and] methodologies when we can’t even have an agreement to eliminate the ones that are obviously incompatible…I mean, it’s not even climate ambition, in many cases it’s common sense.”

Though Dufrasne agrees that Article 6 is a highly technical issue to resolve, he argues that many of the remaining issues are political. He says parties are using the complexity of the text to hide the fact that some of their proposed rules would allow “blatant cheating”.

A wind farm in Rajasthan, India. Credit: jeremy sutton-hibbert / Alamy Stock Photo.

This is particularly pertinent for nations that are considered most vulnerable to the impact of climate change, who have been vocal in negotiations about the risks of weak Article 6 rules.

MJ Mace, a negotiator for the Alliance of Small Island States (AOSIS) group, tells Carbon Brief “we absolutely cannot afford to allow markets to undermine mitigation ambition”. She continues:

“There can be no double-counting of emissions reductions and there can be no creation of hot air. Related to this, we cannot support a carryover of pre-2020 Kyoto Protocol credits or allowances, which would undermine what we are trying to achieve through the Paris Agreement.”

According to Mace, there is also vocal opposition from wealthy countries including Australia, New Zealand, Japan and Norway to stricter rules for reducing emissions through trading (see sections on “OMGE” and “share of proceeds” for more detail), and increasing the “share of proceeds” given to adaptation projects.

As countries that are likely to be buyers on the carbon market, Mace says they are primarily concerned about cost: “They do not want to have to pay more to meet their targets – even though they will still save money by accessing international credits over the cost of domestic abatement.”

Despite the instruction that Article 6 should learn from the experiences of the past, Dufrasne tells Carbon Brief it still looks likely that history is going to repeat itself:

“Both Article 6.2 and Article 6.4 are on the path, at the moment, to repeat many of the mistakes [of Kyoto], I think.”

At the heart of the Article 6 discussions are a handful of key issues that must be resolved in order to proceed with its implementation in the Paris “rulebook”.

This is easier said than done. Jennifer Tollmann from green thinktank E3G notes “the old adage” at the UN climate talks that “nothing is agreed until everything is agreed”. She tells Carbon Brief:

“I think the big issue is that there are different groupings for different bits of the markets discussion and that’s what makes it so complicated because, at the end of the day, you have to bring together all these different fault lines in a package.”

Ensuring the bilateral trading of Article 6.2, the global market mechanism of Article 6.4 and the non-market framework of Article 6.8 are all resolved satisfactorily, while maintaining the Paris Agreement’s integrity, requires some “fairly complicated maths,” says Tollmann.

In this section, Carbon Brief summarises the key issues at stake…

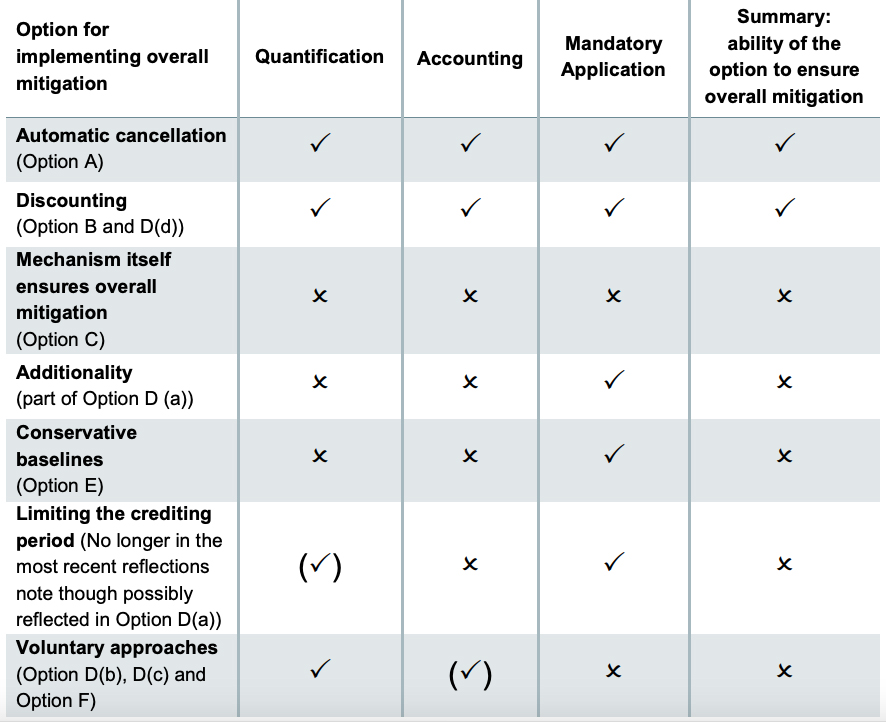

Unlike the carbon-trading arrangements under Kyoto, Article 6.4 markets are required to ensure an “overall mitigation in global emissions” (OMGE). This means they should ensure a net reduction in emissions, rather than just offsetting CO2 released in one country with savings elsewhere.

“After years of being trapped in the offsetting world of the Kyoto Protocol, we now need to do better,” AOSIS negotiator MJ Mace tells Carbon Brief.

While the Paris Agreement only mentions the goal of OMGE in Article 6.4, there is a strong push by vulnerable countries, in particular, to make sure it covers trading under Article 6.2, too.

They argue that unless this is done, the balance will be tilted in favour of Article 6.2 trading, due to the lack of constraints and regulation, meaning the Article 6.4 mechanism will be weakened. Mace says wealthier countries have opposed this move:

“These countries argue that the market should not be encumbered, and Article 6, simply by its operation, will deliver net global mitigation – for example, by enabling more ambitious future targets.”

However, for many observers and parties OMGE is regarded as more than just the passive result of Article 6 in action.

They see it as being achieved only when a fixed share of any Article 6 carbon credits are set aside and not used by any party towards their climate targets. These credits would be cancelled or put aside to the benefit of the world’s atmosphere as a whole, rather than for a particular state and its NDC. However, figuring out how this would work in practice has proved difficult.

While a few measures to guarantee overall mitigation are being considered, for many NGOs and high-ambition parties there is only one feasible option on the table: automatic cancellation.

If this was implemented, every time a credit was transferred from a host country to another, part of it would be “cancelled”. (Options remain in the text that would implement this cancellation either at the time of issue in a host country, or only later, at the point of use.)

So if, say, 100 credits were transferred, representing 100 tonnes of CO2e (tCO2e), then the receiving country might only be allowed to count 80 of those credits towards its targets. In doing so, 20tCO2e would not be counted by anyone and, overall, mitigation would be achieved.

“There is no other option in the text that does that, all the other options would basically replace that effort somewhere else,” explains Gilles Dufrasne, from the NGO Carbon Market Watch.

A report by the NewClimate Institute reinforces this idea. It says that to guarantee OMGE, the emissions reductions from an Article 6 project must be quantified and then a percentage cancelled, not to be used towards an NDC. It says this approach must be mandatory.

Other measures under consideration are seen as important, but unlikely to deliver OMGE on their own, according to the report. Voluntary cancellation of credits, for example, is ruled out as unrealistic, because while welcome it is optional and, therefore, unreliable.

The report says that ensuring “additionality” is also insufficient to deliver OMGE, particularly as it should be guaranteed in any case. (Additionality is a test to make sure that projects cut emissions by more than the amount that would have been saved anyway.)

Of the options suggested, the report concludes only automatic cancellation and “discounting” – effectively, cancellation by the acquiring party – fulfil all these requirements.

Summary of the assessment of options for implementing an overall mitigation of emissions (compared to a scenario in which trading did not take place at all) against a set of criteria for ensuring that overall mitigation has taken place. The NewClimate Institute concluded that only automatic cancellation and “discounting” – which differ with regards to when credits are cancelled and whether the host country or the acquiring country is responsible for cancelling them – were enough to ensure overall mitigation. Source: NewClimate Institute.

However, automatic cancellation is far from universally popular. The main argument against the idea is summarised by Dirk Forrister from IETA, who says such a strategy would make the process more expensive by adding “a form of taxation to trades that would discourage use of trading”.

There is also the concern that if fewer emissions reductions are traded, then there could be fewer sales to finance the Adaptation Fund via “share of proceeds” (see below).

However, supporters of automatic cancellation argue that an increase in offset prices – due to reduced supply – is likely to be more pronounced than the decrease in the volume of credits transacted, so that the higher prices could make up for the shortfall in adaptation funding.

They anticipate that future demand for offset credits will be fairly stable, no matter what the price, with schemes such as Corsia needing to use them even at higher prices.

Another concern is that automatic cancellation might incentivise a race to the bottom in offset quality, favouring projects with seemingly large emissions reductions over those creating more genuine CO2 reductions.

Similarly, if OMGE is also applied to Article 6.2, then it could give a misleading badge of “net mitigation”, even where trading is based on “hot air”.

A widely discussed alternative to automatic cancellation is termed “conservative baselines” and involves setting the baseline for emissions-cutting projects artificially high. For example, if a project brought a reduction of 100tCO2e, only 80 credits would be released.

However, this would not be “true” OMGE as defined by the NewClimate Institute and others, as the extra 20 tonnes of emissions would still count towards the original country’s NDC, as opposed to the NDC of the country the credits were sold to. This contrasts with automatic cancellation where no country is allowed to count the credits in its NDC.

With discussion still on-going about how best to achieve OMGE, Dufrasne says that “unfortunately” automatic cancellation is not being advocated by many countries at the moment and he says “there is a lot of misunderstanding around what baselines will do”.

At the end of COP24 in December 2018, the draft texts on both Article 6.2 and Article 6.4 included voluntary cancellation to achieve OMGE, but did not have options based on automatic cancellation.

Notably, however, the phrase “double counting” does not appear in Article 6.4. Instead, it has a provision “viewed as key” by Brazil, according to a report on the genesis of the Article 6 text, published in 2018 by the European Capacity Building Initiative (ECBI).

This key provision says that the host of a carbon cutting project “will benefit from mitigation activities resulting in emission reductions that can also be used by another party to fulfil its nationally determined contribution”.

This language was “exhaustively negotiated among parties until the very final stages of COP21 [in Paris]”, according to the ECBI report. It also appears to lie at the heart of the double-counting dispute, with Brazil arguing, on the basis of this provision, that host nations need not make corresponding adjustments after selling carbon credits, whereas the EU, among others, strongly disagrees.

Adding to this contentious and potentially ambiguous language, Article 6.5 then says that any emissions reductions resulting from the new carbon-trading mechanism:

“Shall not be used to demonstrate achievement of the host party’s nationally determined contribution if used by another party to demonstrate achievement of its nationally determined contribution.”

Despite the seemingly simple arithmetic underpinning corresponding adjustments for traded emissions savings, the ambiguity around Article 6.4 has allowed some parties to push for options that would amount to a green light for double-counting, according to most other countries.

Chief among these is Brazil, which has made it a central point of its stance during discussions of carbon markets at recent talks, as Forrister explains:

“Brazil and some others still support Article 6.4 sales without an accounting adjustment for the host nation…From our vantage point, you still need to have the adjustment to build a system that has broad public support, with accounting that has full integrity and that can support investment at scale.”

Brazil’s fingerprints can be seen in the square-bracketed “option C” of the current draft text on “avoiding the use of emission reductions by more than one party”, which states: “A party hosting Article 6, paragraph 4, activities shall not be required to make a corresponding adjustment.”

A related option in the draft text for Article 6.2 says that the broad requirements on avoiding double-counting, already adopted under paragraph 77(d) of the Paris rulebook, would be “supecede[d]” by the Article 6 rules. This is, effectively, an attempt to reopen the debate.

With his nation gaining notoriety for its role in disrupting proceedings, towards the end of COP24, Brazil’s secretary for climate change and forests, Thiago de Araujo Mendes, wrote a letter to the Guardian defending his country’s position on double-counting.

While he insisted that Brazil is “absolutely opposed to double-counting when it comes to carbon credits,” he also argued that there should be no need for a county hosting offset schemes to make corresponding adjustments, to reflect the sale of credits.

The basis for this position appears to be “additionality” – the idea that the emissions reductions taking place are on top of those that would have been generated without markets. The letter reads:

Under Brazil’s proposed system, there would be no corresponding adjustment when the carbon offset “unit” first leaves the country, but there would be adjustments for any subsequent transfers between other countries of that unit. Mendes adds:

“Otherwise, double-counting will occur, which is exactly what Brazil and many other countries have sought to prevent.”

So if, say, Brazil transferred a credit to Germany, Brazil would make no corresponding adjustment. But if Germany subsequently decided to trade that credit to the UK, it would have to make an adjustment.

Most countries do not see things the way Brazil does, viewing emissions reductions – whether “additional” or not – as things that should be reflected in accounts simply with a “plus” on one side of the deal and a “minus” on the other side.

Alessandro Vitelli, a freelance journalist covering carbon markets who has followed UN discussions on the matter for 15 years, tells Carbon Brief: “Brazil operates banks. It must know this runs counter to any standards of financial accounting.”

Dufrasne notes that while Brazil has received the “bad guy” tag, other nations have also been “very happy with this position”. He gives the UNFCCC negotiating bloc known as the Arab Group as one example. Other nations, including India, have also occasionally provided support on this issue at times, according to several observers of the negotiations that spoke to Carbon Brief.

As for the motivation behind the position taken by Brazil and its allies, Carbon Brief heard a slightly different explanation from each of the sources interviewed for this piece. Dufrasne says these countries probably simply want to sell units while still using them towards their own NDC.

Other sources, including Vitelli, speculated that it could potentially also be seen as a “bargaining chip” in the negotiations, which could be “given away” in return for looser rules governing the carry-over of credits from the CDM – of which Brazil was one of the main beneficiaries. (See below.)

One observer at the negotiations, who has asked not to be named due to the sensitive political nature of this dispute, tells Carbon Brief that the justification for Brazil’s position is unclear:

“Nobodies really understands how they can argue that, maybe not even them. Increasingly complex arguments are being created to explain it.”

Regardless of the justifications, sources Carbon Brief spoke to, including E3G’s Tollmann, suggested it is unlikely that nations who say they are committed to ambitious climate action, such as members of the EU and Environmental Integrity Group, will back down on this issue.

One possible compromise could be to temporarily allow the Brazilian position for a few years, before committing to tighter rules on double-counting, although Dufrasne says he does not think this is “realistic”. (The draft text shown above includes options applying “from [X date]”.)

When the BASIC (Brazil, South Africa, India, China) countries met in Beijing to discuss climate change in October 2019, they reaffirmed their commitment to concluding Article 6 discussions, including “ensuring environmental integrity and avoiding double-counting”.

The Article 6.2 mechanism for trading between countries is relatively loose, with few rules or restrictions set at the international level. However, it does insist that such trading must be subject to “robust accounting” for the purposes of transparency and avoiding double-counting.

The Paris text asks for practical instructions to be drawn up on how this should be done. It adds that parties must remain “consistent” with this guidance when accounting for Article 6.2 trading.

This accounting guidance is a key part of the ongoing negotiations over the Article 6 rulebook. It must also grapple with the technical challenge created by inconsistency between different countries’ NDCs.

Specifically, most NDCs are based on single-year targets – a 40% cut in emissions by 2030, for example – whereas it is the cumulative total of emissions over time that matters to the atmosphere. However, very few NDCs set a target for an emissions budget across multiple years.

If a country with a single-year target were to buy emissions credits and apply them all to the target year in its NDC, then it could avoid cutting emissions in other years and meet its goal with minimal effort. This would clearly go against the spirit of “environmental integrity” as it would mean meeting climate targets without actually benefiting the atmosphere.

The situation “could potentially lead to an overall increase in emissions and raise environmental integrity risks”, says a June 2019 report from the OECD group of developed countries and the International Energy Agency.

A lack of agreement over how to solve this problem reflects the technical challenges it presents, rather than any political divisions over the appropriate solution, says former co-chair Kizzier.

The OECD/IEA report sets out five alternative accounting approaches, currently being considered for the tracking of trading between countries with single- or multi-year targets. These are:

Although this debate might appear rather dry, the choice of a specific accounting approach has the potential to determine whether or not a country is considered to have met its climate goals. This adds a frisson of political excitement to the otherwise technical accounting negotiations.

The OECD/IEA report points to the “averaging” or “cumulative” approaches to accounting as offering the greatest protection against “environmental risks”, by which it means avoiding a situation where trading under Article 6.2 leads to higher atmospheric greenhouse gas levels.

Towards the end of COP24 in December, however, the draft text offered a menu of accounting approaches, shown below, including “multi-year trajectory”, “yearly”, “cumulative” and “averaging”, with countries given the choice of which method to use.

This approach, if adopted by the final Article 6 rules, would offer countries “national determination”, in line with the relatively loose structure of Article 6.2. But it could also restrict the potential for trading, since some accounting methods “may be incompatible”, the OECD/IEA report says.

A lengthy section of the current negotiating text includes a similar option, where countries can choose their own approach to avoid “double-counting”. However, it also includes more restrictive options, one of which would require all countries to use the “averaging” method.

A final problem, as the OECD/IEA report notes, is that some NDCs do not set targets in terms of emissions at all – for example, aiming to cut the emissions associated with each unit of GDP. “It is not yet agreed how to account for these targets,” the report says.

Negotiators are also grappling with a second source of potential perverse incentives under Article 6, that could work against the grain of the Paris Agreement and could weaken climate ambition.

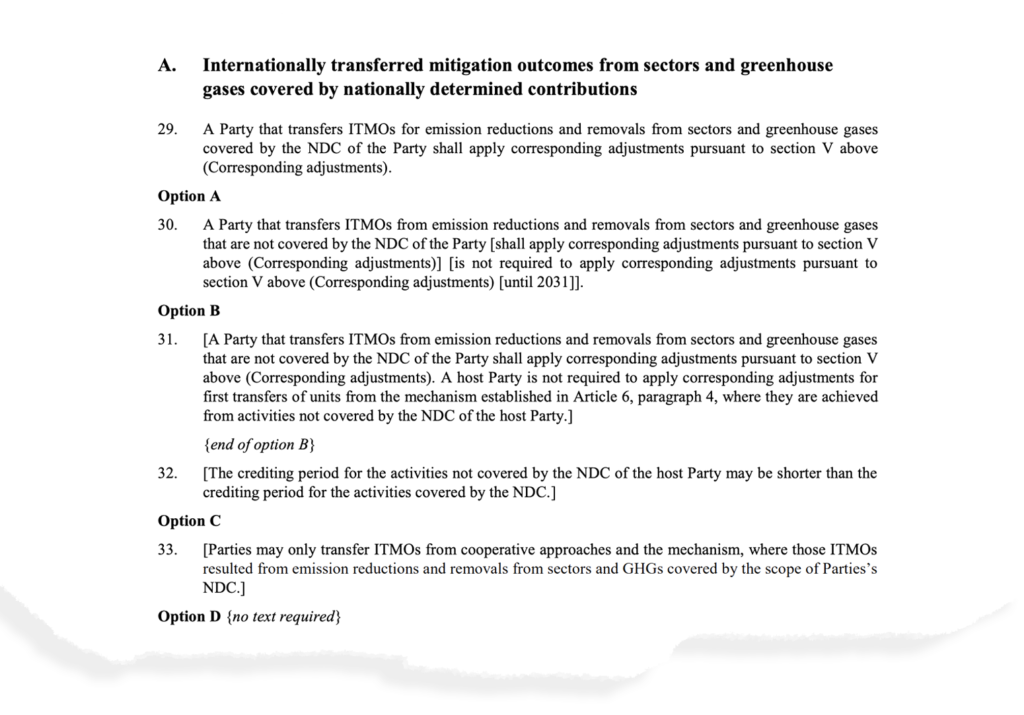

The issue would arise if a host country were to sell Article 6 carbon credits that were created in a sector falling “outside” the scope of its NDC, as opposed to falling “inside” the pledge.

The concern is that this income would act as an incentive to keep certain sectors “outside” a country’s goals, so that it could continue to cash in without affecting the targets “inside” its NDC.

This would be contrary to the spirit of the Paris deal, which says that developed countries “should” set an emissions-cutting target that covers every sector of their economies, from electricity generation to industry, transport and agriculture. It could encourage developing countries to limit their NDCs, even though they are “encouraged” to move towards economy-wide emissions targets.

[In the “crescendo of words” used in UN legal drafting, “should” is an exhortation, but is not legally binding, whereas “encourage” is weaker still.]

A technical challenge to the “inside/outside” debate is that NDCs are highly diverse and many of them are not structured around emissions in particular sections of the economy, says Isabel Cavalier, senior adviser at campaign group Mission 2020. She tells Carbon Brief:

“For some NDCs it isn’t even clear what it means to be outside the scope. If you have an intensity-based target [for example, emissions per unit of GDP]. Or if you have an adaptation-based NDC. This issue is very present in the negotiations.”

This situation could become even more complicated and fraught if “corresponding adjustments” are required after the sale of carbon reductions “inside” a country’s NDC, but not when savings are from sectors “outside” the scope. Carbon Market Watch’s Dufrasne tells Carbon Brief:

“Basically, you are telling the country that if it expands its NDC to cover this new sector then it can’t continue to sell emission reductions in the same way as it has been doing in the past. This sets a direct incentive for countries not to include this sector inside their NDC, and that’s how a perverse incentive is created.”

On the contrary, according to IETA’s Forrister, the existence of the Article 6 trading mechanisms could actually help developing countries to expand the scope of their NDCs. IETA’s starting position is that all NDCs should be economy-wide as soon as possible, Forrister says.

Before that happens, he suggests that trading could bring investment and expertise to new sectors, where a country may lack the technical capacity to monitor emissions. He adds that if countries’ NDCs are limited in scope, it should not be the responsibility of markets alone to fix the problem.

There are several options on the table that would limit or avoid any perverse incentives due to Article 6 trades for sectors outside the scope of a host country’s NDC.

The extract below shows the menu of options being considered for the Article 6.2 rulebook. The text starts by saying, in paragraph 29, that “corresponding adjustments” are required when traded emissions savings come from within the scope of a host NDC (“the Party shall apply”).

Under options A and B, there would be an exception such that host countries would “not [be] required” to make a corresponding adjustment, when trading reductions outside the scope of their NDC. This exception could be time-limited, with option A including “until 2031” in square brackets.

Conversely, option C would remove the potential for perverse incentives by excluding the sale of emissions savings that fall outside a host NDC scope. In this case, countries would have an incentive to expand their NDC scope so as to be able to sell more emissions reductions.

A similar menu of options is under discussion for the Article 6.4 rulebook. Again, this includes the option to create a time-limited exception for credits traded from outside the scope of an NDC.

For Article 6.4 trading, there is a further question around whether to apply corresponding adjustments to the sale of credits for use under the Corsia offset scheme for aviation. This might be applied only to reductions generated within the scope of the host nation’s NDC, or to savings created either inside or outside its scope.

Another of the most contentious questions for the negotiations is whether to allow Kyoto-era projects into the Article 6.4 trading scheme, along with the methodologies governing how they calculate their CO2 savings and the carbon credit “units” they have already generated.

This debate comes despite the Paris Agreement not actually calling for such a transition. In fact, the Paris decision text explicitly “encourages” the voluntary cancellation of Kyoto-era units.

Nevertheless, several countries that are host to large numbers of ongoing CDM projects, such as Brazil and India, are keen to allow their full transition along with Kyoto-era methodologies and units. Others fear a full transition could undermine the ambition of the international climate regime, by allowing already-weak targets to be met without any additional effort.

The scale of the issue is large, with nearly a billion tonnes of Kyoto-era “units” available now – and even more potentially able to be generated or registered by ongoing projects. The UN Framework Convention on Climate Change (UNFCCC) estimates there could be between 2.3-5.4bn of these units up to 2020. At the top end, this is equivalent to the EU’s entire annual emissions.

A recent World Bank report says there are nearly 8,000 projects registered under the CDM, some of which could continue to operate for many years.

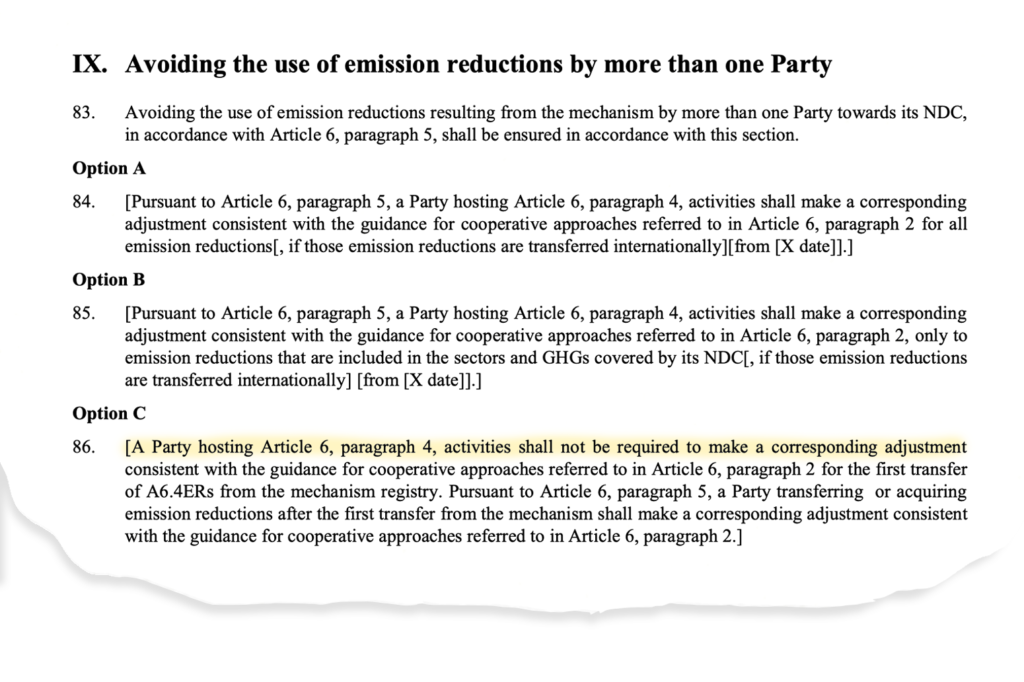

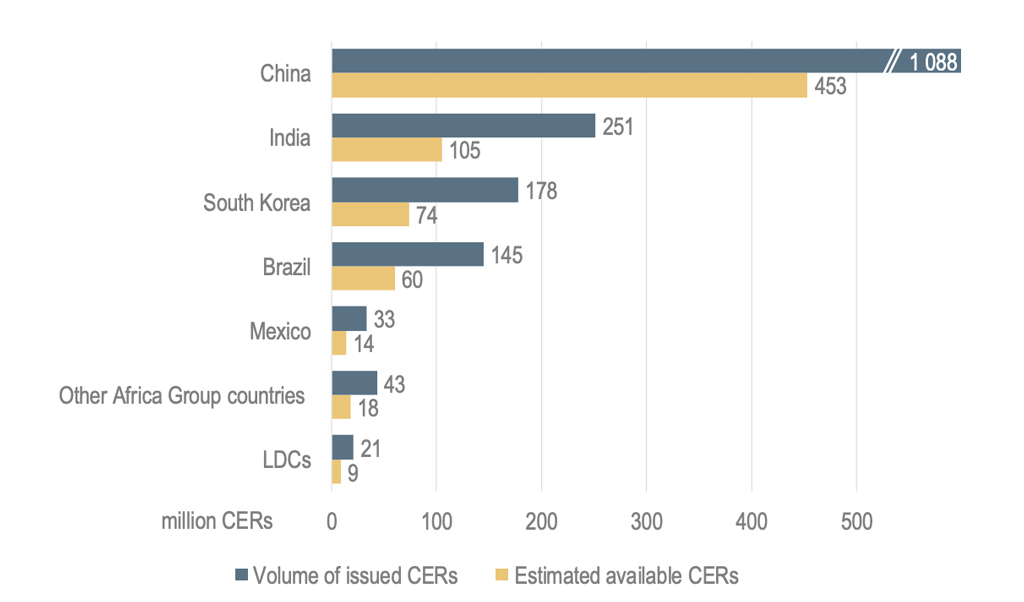

These projects have already issued “certified emissions reduction” (CER) units equivalent to some 2GtCO2e, says a June 2019 report from the OECD group of developed countries and the International Energy Agency.

It notes that China, India, South Korea, Brazil and Mexico account for 85% of this total, as the figure below shows. CERs that have already been used are shown in blue, while those still available for use are in yellow.

Number of “certified emissions reductions” (CERs) issued by each country or grouping (blue) and potentially available for issuance (yellow) as of 31 December 2018. LDC is the group of least developed countries. Source: OECD/IEA.

In addition, many registered CDM projects are not currently issuing CERs, but could generate them retroactively, the OECD/IEA report explains. It adds that these “dormant” projects could, in principle, issue another 4.7bn of CERs to the end of 2020 – for example, if market prices increase.

It compares this total with a much lower potential demand of 0.3bn units to 2020 – and less than 3bn units of demand expected from the Corsia scheme for international aviation through to 2035.

(IETA’s Forrister says he takes the 4.7bn figure on potential Kyoto carryover with “an enormous grain of salt” and adds that “it’s unlikely those volumes would materialise” from dormant projects.)

The main risk of a full transition of these projects and carbon reduction units is that it could undermine further action being taken to cut emissions. On the other hand, the OECD/IEA report notes, a full or partial transition could create a ready-made inventory for the Article 6.4 marketplace, allowing the scheme to start operating almost immediately.

The OECD/IEA report says that a full transition of Kyoto projects “could inhibit (or at least delay) the development of new, additional mitigation activities, because it would allow investments made before 2020 to generate credits in the Article 6.4 mechanism”.

It adds that a full transition of current and potentially available CDM credits “carries a strong risk” that Article 6.4 would fail to generate additional emissions cuts beyond what would have happened anyway, with this “potentially putting at risk environmental gains”.

The OECD/IEA report explores various options for partial carryover. These include a “vintage restriction” that would only allow units created after a certain date to be used under Article 6.4, or a geographical restriction, allowing carryover of only the relatively small number of units generated in the group of least developed countries.

These compromise options could form part of the horse-trading at the talks – for example, being given in exchange for stricter rules governing the international carbon market, as Costa Rica’s De Leon tells Carbon Brief:

“One potential area of compromise is allowing banking of some pre-2020 credits, as long as we get a robust accounting system for the future because it is the long term that matters. In principle, I could agree with that, except that it is the next 10 years that will matter for 1.5C – and if we allow a few hundred million tonnes to come in you’ve basically written that off.”

The OECD/IEA report says that the potential supply of carryover CDM credits “could be very large relative to the estimated demand”, meaning that a full transition would “be likely to heavily dilute the market of the Article 6.4 mechanism from the outset”. This, it continues, “could lead to low credit prices and less incentive for private sector investment”.

In a similar vein, the World Bank report says:

“[Some] countries and stakeholders are concerned that [transfer of Kyoto credits into Article 6.4] could oversupply the market under the Paris Agreement, and have voiced concerns over the robustness of the CDM’s rules with respect to the quality of the CERs issued.”

These concerns over the quality of CDM credits – known as “certified emissions reductions” (CERs) and each representing one tonne of CO2 equivalent – are reflected in their current cost of close to $0.2/tCO2e. The World Bank puts this low cost down to a lack of demand.

IETA’s Forrister echoes this view, telling Carbon Brief:

“There is hardly any market demand for CDM credits…Broadly speaking, buyers don’t see them as credible. Market confidence has gone away because the rules were not tight enough.”

However, Forrister says that “there is value” in the infrastructure that was developed under the CDM to govern its emissions-cutting projects, including the cycle of registration and verification. Similarly, Forrister says that “many of the CDM methodologies have been gradually improved” and could be transferred or used as the basis for Article 6.4 methodologies in the future.

The current negotiating text includes a full menu of options on the transition of Kyoto Protocol activities, units and methodologies. These would allow full transition, various forms of partial transition, explicitly rule out any transition or defer the decision until later.

The extract below shows the menu for Kyoto-era projects: allowing all of them to be registered under Article 6.4 (option A, below); allowing for the registration of those activities that meet new requirements and potentially fixing a time-limited transition period (options B and C); ruling out any transition (option D); or deferring the decision until a later date (option E).

The Kyoto-era projects, methodologies and carbon units are not the only potential hangover from its trading systems. The protocol also allowed countries that overachieved against their emissions budgets to sell “assigned amount units” (AAUs) for use towards another nation’s goals.

Some 15bn of these AAUs are still in the system, largely as a result of weak targets that were easily met without any climate policy intervention. These AAUs could potentially be used to meet future targets under the Paris Agreement, meaning no additional climate action would be required.

This matter is of particular interest to Australia, where the government has said it intends to make use of the AAUs it holds, as a result of overachieving its Kyoto Protocol targets. At present, the negotiating text for Article 6.4 does contain the option to rule this out, with square-bracketed text stating “Kyoto Protocol units may not be used by a Party towards its NDC.”

A politically charged sticking point in the Article 6 negotiations has been how to guarantee that a meaningful “share of proceeds” from trading is used to support adaptation in vulnerable countries. This is explained in Article 6.6, which says the COP:

“Shall ensure that a share of the proceeds from activities under the mechanism referred to in paragraph 4 of this Article is used to cover administrative expenses as well as to assist developing country Parties that are particularly vulnerable to the adverse effects of climate change to meet the costs of adaptation.”

This means carbon markets would generate a stream of finance for developing nations, helping to fund their efforts to prepare for climate change. Understandably, alongside achieving OMGE, this has been a key issue for small islands and other vulnerable nations.

Such a system is already in place under the Kyoto Protocol’s Clean Development Mechanism, with 2% of the “certified emission reductions” (CERs) it issues set aside towards administrative costs and the Adaptation Fund.

According to the Center for Climate and Energy Solutions (C2ES), as of June 30 2018, “monetisation of the levied CERs has provided $199.4m of the fund’s cumulative $753.3m in receipts”.

The main source of debate when considering how to apply this to Article 6 markets is the breadth of its coverage. While the Paris Agreement, as it stands, requires this levy to be taken from all Article 6.4 activities, many developing nations have been pushing to extend it to Article 6.2 as well.

However, many wealthier countries are unwilling to accept this, leading to a stalemate. The battle lines are similar to those for and against “automatic cancellation” to achieve OMGE – with one side arguing for a mechanism that the other side says will actively discourage trading.

Developing nations argue that if such a system is not applied to both markets, besides providing fewer proceeds for the adaptation fund, it will result in an unbalanced situation where Article 6.2 is less regulated, meaning nations might opt to use it instead of the stricter Article 6.4 scheme.

AOSIS negotiator MJ Mace says that balance is needed to avoid one scheme “undermining” the other. She says that OMGE and share of proceeds must be applied to both “because it is increasingly clear that 6.2 and 6.4 will compete directly”.

She says her bloc has been consistent in calling for 5% of proceeds to go towards adaptation from both markets. Under the CDM, 2% of issued credits go towards the Adaptation Fund.

The opposition from wealthy nations arises because many of them are enthusiastic about using Article 6.2 to link up the domestic emissions trading systems they already have in place, similar to how the EU and Switzerland or California and Quebec already have linked trading schemes.

The argument goes that taking a share of proceeds from international transfers, within these linked markets, would “distort” trading by placing a cost on those transfers. Dufrasne from Carbon Market Watch explains how this might work out:

“A European company would buy a permit from a Swiss company and the share of proceeds would apply. Suddenly, a European government would have to pay money to the Adaptation Fund even though it didn’t have any control over the actual transfer of emissions.”

One alternative, according to C2ES, would be to ask participating parties to report on how mechanism revenues are being used to support adaptation in developing countries, in the absence of a fixed levy being extracted.

In Katowice, the share of proceeds section of the draft Article 6.2 rules remained unresolved, suggesting it was one of the most contentious issues in the negotiations. Since then, an even longer list of options has been reintroduced to the latest text.

The latest draft Article 6.4 rules cover a smaller menu of options, setting aside two, five or “X per cent” of proceeds for adaptation and levying a fixed monetary amount of “X” for administration.

After the meeting in Bonn earlier this year failed to make much headway, Article 6 remains the most pressing issue in UNFCCC proceedings as delegates assemble in Madrid for COP25.

There is a degree of optimism in the air, tempered by an understanding that most of the issues that have been present from the beginning remain unresolved.

In essence, there are a few key groupings of nations that are sticking stubbornly to their positions, and they will have to show a degree of compromise if the matter is to be resolved.

Vulnerable nations such as small island states want automatic cancellation to ensure OMGE and a guaranteed share of proceeds for both Article 6.2 and Article 6.4 markets. The EU and US are focused on strong rules that mean carbon markets can function transparently.

Brazil will try and likely push ahead with its controversial position on double-counting, as well as the transition of old Kyoto Protocol projects and units, potentially with support from the likes of India and Russia.

COP25 has already been the subject of much drama, after the summit was briefly cancelled by Chile following mass civil unrest in Santiago, the host city, before being hastily transferred to the Spanish capital.

Chile, which has retained the COP presidency, is expected to be looking for a “win” at the event and Article 6 is, perhaps, the most obvious issue to target.

However, it could be that many parties, particularly those concerned with the integrity of these carbon markets and their potential to result in more emissions being released, are unwilling to compromise for the sake of a deal in Madrid.

Both negotiators Mace and De Leon express the view that “a bad deal is worse than no deal”. Mace tells Carbon Brief “the ‘compromises’ that have been presented thus far are completely unacceptable to vulnerable countries”.

Such compromises may not only be bad news for the climate, but also for the parties presumably hoping to profit from these markets, as Forrister explains:

“Who’s going to be willing to trade with you? If you’ve got a really weak system, you won’t attract investment. You do need rules so that people are willing to lean into this system.”

At the “pre-COP” meeting in Costa Rica in October, a group of parties including the EU, Costa Rica, Colombia, Senegal, New Zealand and AOSIS gathered to set out red lines they said must not be crossed if the integrity of the Paris Agreement is to be maintained in Article 6 negotiations.

Among these red lines, set out in an unpublished document seen by Carbon Brief, were the strict avoidance of double-counting, a ban on the use of pre-2020 Kyoto credits and the delivery of OMGE.

The principles document references the “best available science” underpinning demands for the “highest possible ambition” to achieve the Paris Agreement goals.

However, the document was never formally released. Carbon Brief understands that the group decided not to release it, given the risk of alienating other parties that might disagree with its high-ambition checklist and in the context of trying to reach consensus on Article 6 at COP25.

Whatever the outcome, EDF’s Kizzier says nothing is stopping parties interested in “high integrity” outcomes setting additional, domestic restrictions on the use of Article 6 trading.

According to E3G’s Tollman, the “best-case scenario for Article 6” is that countries reach political consensus at COP25, while leaving the technical details to be agreed later.

She tells Carbon Brief: “The great temptation, particularly for Chile, is going to be to just get consensus at all costs.” Tollman adds:

“The thing is, the Paris Agreement could live on fine if there was nothing agreed on Article 6.4. Countries wouldn’t be happy because they do want market mechanisms, but it could live on fine. The real danger is in Article 6.2 on bilateral, voluntary trading, because if there are no rules agreed by the COP then countries just make their own rules.”

If there is no agreement by the end of the COP25, then the issue will be punted to COP26 in Glasgow, in December 2020, leaving the UK to front the diplomatic push to get it over the line.